I am an anxious person and nothing is quite so effective as a sink for this brain energy as my finances. So when I signed my most recent employment contract, and it came with choices for mutual funds in my employer-matched RRSP, my first actual investment, I deliberated at length. I met a financial planner who told me to invest in equities because of my age. I weighed fractions of a percent in return and fees. I scoured for taboo investments to exclude. The result was a satisfying mix of different funds. Then, I went further. I maxed out my employee share purchase plan and opened another investment account at my bank with much the same mix.

I made pretty good returns, but I could not leave well enough alone. There were no more decisions to make, yet I still needed to flare off brain gas. Something about dollar symbols, commas and decimals made me want to tinker. I was convinced I could do it on my own, so I read up. It wasn’t long before I decided that my risk tolerance was actually quite low and realized that all my investments were actually quite risky. So I ticked some boxes on a form and converted 50% of the equity funds in my company RRSP to treasury bonds. Then sold as much as I could of my company shares and paid off a chunk of my mortgage. I reduced my payroll contributions to the matching minimum and increased my mortgage payments. The end.

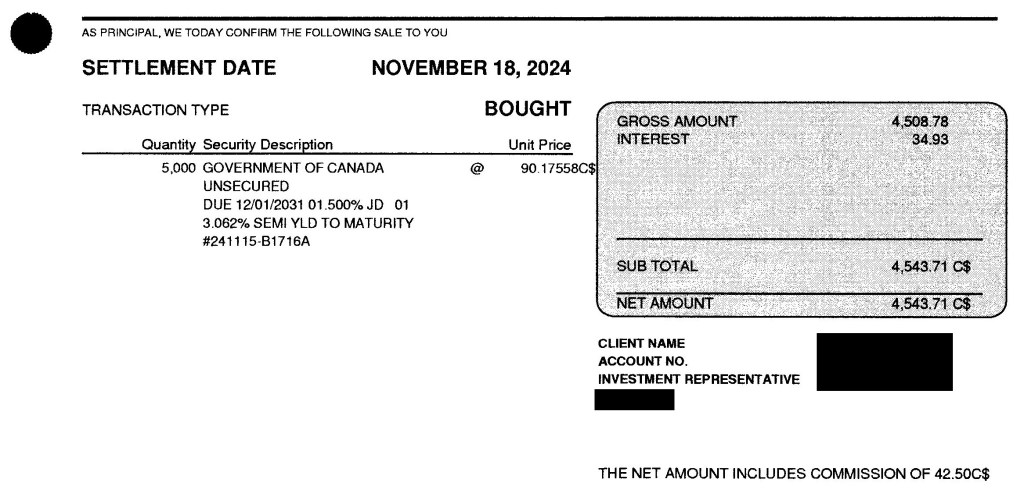

Well, no. There was that third investment, smallest of the three. More than the company RRSP, I had control over the individual investments inside. So it was time to delete those glossy, ultra-growth mutual funds and pick some other things that fit my new criteria. I had enough money to buy individual bonds, and picking them seemed to offer the right amount of mental exercise. New criteria and cash in hand, I looked into online brokerages that offered debt alongside equities. Having settled on one popular brokerage, I decided to test the waters. And so, on November 15, I placed my first order. A few days later, I became the proud owner of $5,000 par of federal 1½% bonds due 2031: security #1 of the new era.

The bond was selling below par, and I stood to make roughly $500 when the bond was redeemed, plus roughly $450 in coupon, over seven years. On an investment of $4500 that’s a return of 21%, or 3% per year (undiscounted). I was happy with that number, but as the confirmation took a predictably long time to arrive in the mail, I wandered over to the CIRO bond look-up, found my transaction and saw that every other time the same bonds were traded on November 15, they sold for less. Even the guy who only bought $3,000 par got a better deal. And thus I’ve traded my other nagging questions for the one that forms the premise of this story: Can I live with that price?

In the coming chapters, I’ll look for the answer in the numbers on that receipt.

Leave a comment